A Comeback Can't Be Ruled Out For Chesapeake Energy

Summary

The scenario in the oil market could improve as Bakken production is coming down and OPEC producers are open to capping supply, which is good news for CHK.

OPEC producers can’t afford to raise production as this will harm the OPEC basket price and increase revenue losses, thereby leading to a better demand-supply balance.

CHK’s multi-section lateral strategy is leading to tremendous cost reduction in the Mid-Con Stack, where break-even has dropped below $40 a barrel.

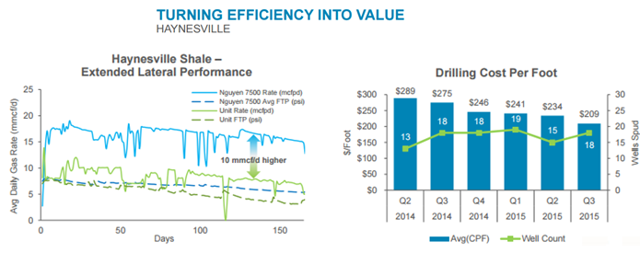

CHK can replicate the multi-section lateral strategy across its other plays such as Haynesville, which will allow it to reduce costs further and benefit from better pricing.

Earlier this month, I had focused on why Chesapeake Energy (NYSE:CHK) is not going bankrupt any time soon, and how an increase in consumption of natural gas, along with a slowdown in production, will improve the dynamics of the market. Since my article on February 9, Chesapeake shares have gained over 17%, driven by the positive news emerging from the crude oil industry. In this article, we will take a look at some more reasons why Chesapeake Energy’s comeback cannot be ruled out.

Positives in the oil market

To counter an oversupplied oil industry, producers have been taking steps to reduce or control production. Now there is evidence that the moves to control production are actually working. For instance, in December, crude oil production from North Dakota’s Bakken play fell 2.5%, according to the latest data released earlier this week.

This was the first time that crude oil production fell in North Dakota sinceAugust 2014, with the decline being driven by a fall in the rig count. At present, the number of drilling rigs operating in North Dakota is at 41, hitting the lowest level in almost seven years. Looking ahead, it won’t be surprising if production from the Bakken continues declining as the number of requests to drill new wells fell to 78 in January, down from November’s count of 125.

Now, this clearly indicates that producers are scaling back production so that they can reduce the impact of weak oil pricing on their cash flow profile by controlling capital expenses. Considering that the Bakken is one of the most important oil plays in the U.S., the decline in production in this area will drag down oil output in the country. As such, it is not surprising to see that the EIAforecasts a production decline of 700,000 million barrels a day in the U.S. this year, and also projects a decline of 200,000 barrels a day next year as compared to 2016.

On the other hand, other major oil producers such as Russia and Saudi Arabia, along with other OPEC member nations, have proposed to put a cap on raising production at January levels. Now, Russia and Saudi Arabia pumped slightly more than 10 million barrels of oil a day in January, making them the biggest producers across the globe. Thus, a cap on production by these two countries will go a long way in reducing inventory levels to some extent.

More importantly, OPEC producers can no longer afford to keep pumping out more oil in the current pricing environment, which is why Saudi Arabia and Russia have softened their stance. This is because the current oil price levels will have a major negative impact on their revenue. As reported by Oil Price:

“The potential loss in annual revenue Russia, Iran, Iraq, and Saudi Arabia will endure were prices to average $26.50 in 2016-Russia ~$36 billion, Iran ~$3.1 billion, Iraq ~$16 billion, Saudi Arabia ~$31 billion.”

Now, if an OPEC producer such as Iran raises production further, the OPEC basket price will decline further and create more revenue losses. As such, it is not surprising to see why Iran supports the production cap as well. Thus, a decline in production in areas such as the U.S. and capping of production by OPEC will be positives for oil pricing, and especially Chesapeake, which has taken steps to reduce costs aggressively.

How Chesapeake is positioned in the oil space?

Chesapeake has been taking organic steps in order to reduce costs that will be sustainable in the long run. For instance, the company has been focused on drilling longer multi-section laterals, which have allowed it to save costs significantly when compared to standard laterals. More specifically, using multi-section laterals can allow Chesapeake to achieve a 27% reduction in completion costs, or around $700,000 per well in the Mid-Continental Stack.

As a result of this strategy, Chesapeake has been successful in reducing the break-even point in the Mid-Continental stack to less than $40 per barrel, a feat that it can achieve in other plays as well. This is because the strategy of Chesapeake to drill multi-section laterals can be deployed across all of its plays, which will allow the company to achieve further cost reductions. For example, the use of longer drilling sections in the Haynesville play has allowed Chesapeake to reduce its drilling cost per foot consistently as shown below:

Source: Chesapeake Energy

Conclusion

Apart from a possible improvement in the natural gas industry, Chesapeake is also well-placed to take advantage of a probable upswing in the oil market. The company has been working in the right areas to reduce costs, which will allow it to make the most of a better oil pricing scenario. Hence, this is another reason why investors should not give up on Chesapeake Energy.